Hello, my friends.

we are in February and DXY has finally broken up the range. I think it’s clear now that we are going to 104.4. There is news only on Monday, then Thursday. So it can be a straight-up move for the first part of the week.

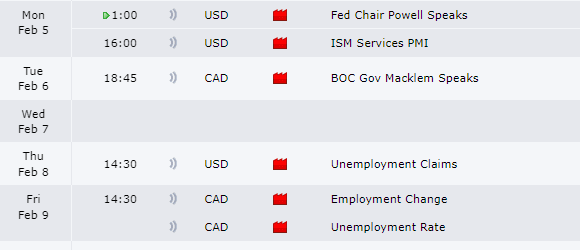

Dollar Index

The dollar has topped in the last year October. Since then the DXY is in the slide down. In my opinion, the price will visit the 100 territories in the future. Market makers have left nice equal lows – liquidity zone. However, I think we still could go a bit higher first. And this week it finally broke up the range and I think we are on the way to 61.8 of that large swing which is around 104.4.

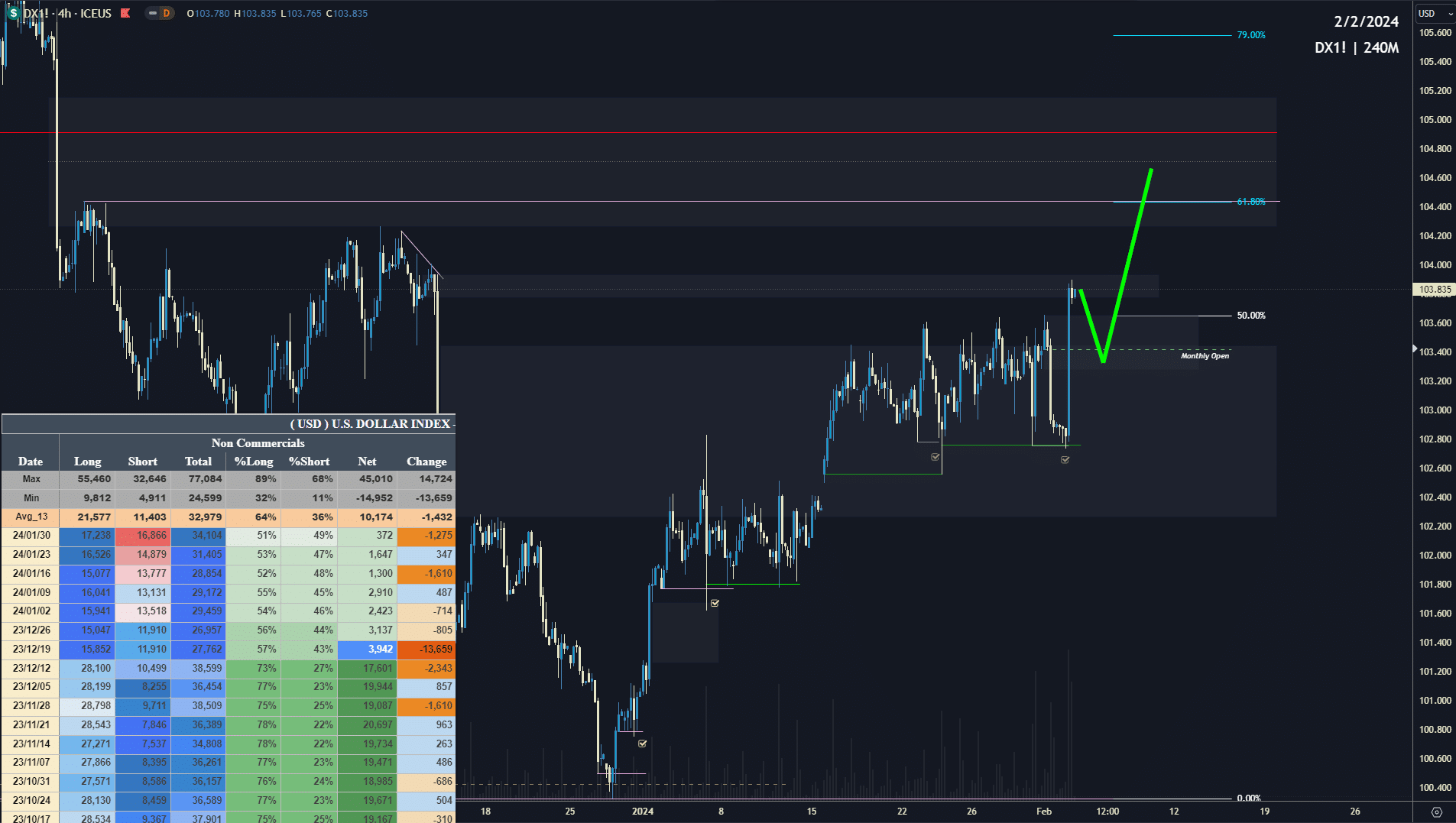

DXY Seasonal tendencies

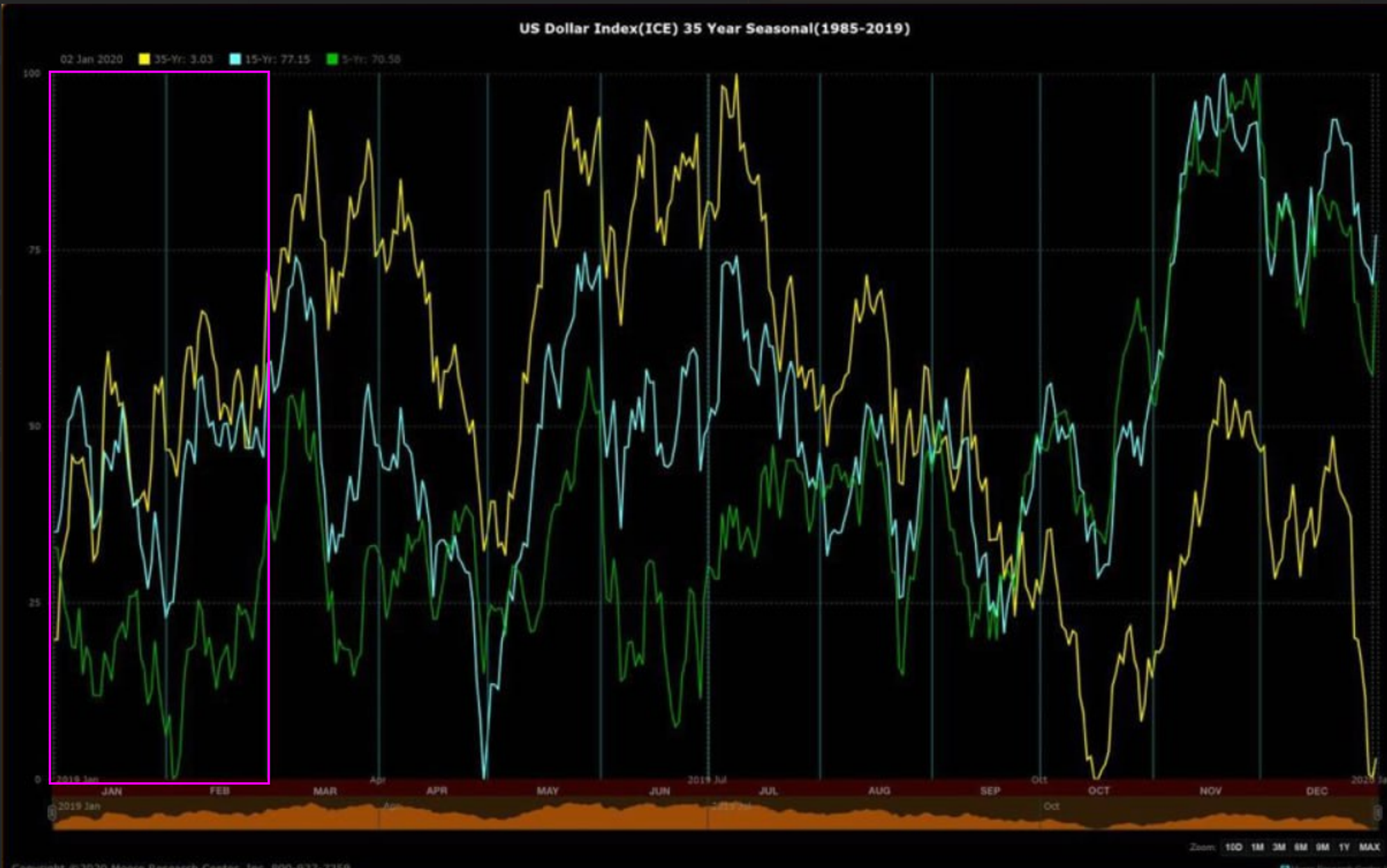

EURUSD

Price has been dropping for the past 5 weeks since it topped in December. And as a mirror of the Dollar Index its going for the liquidity below 50% fib swing. And again. Monthly open and BPR can be nice resistance for short entry.

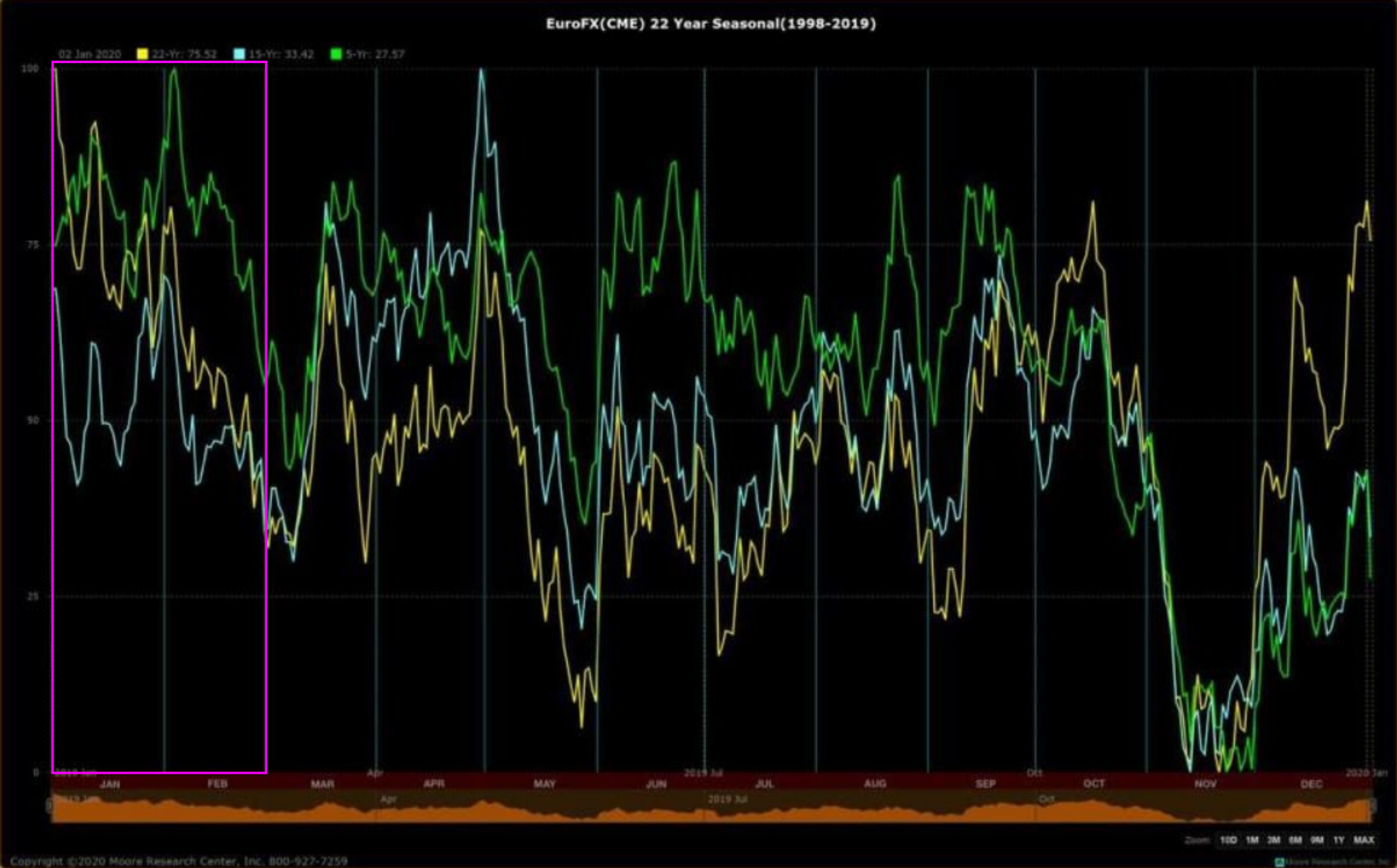

EUR Seasonal Tendencies

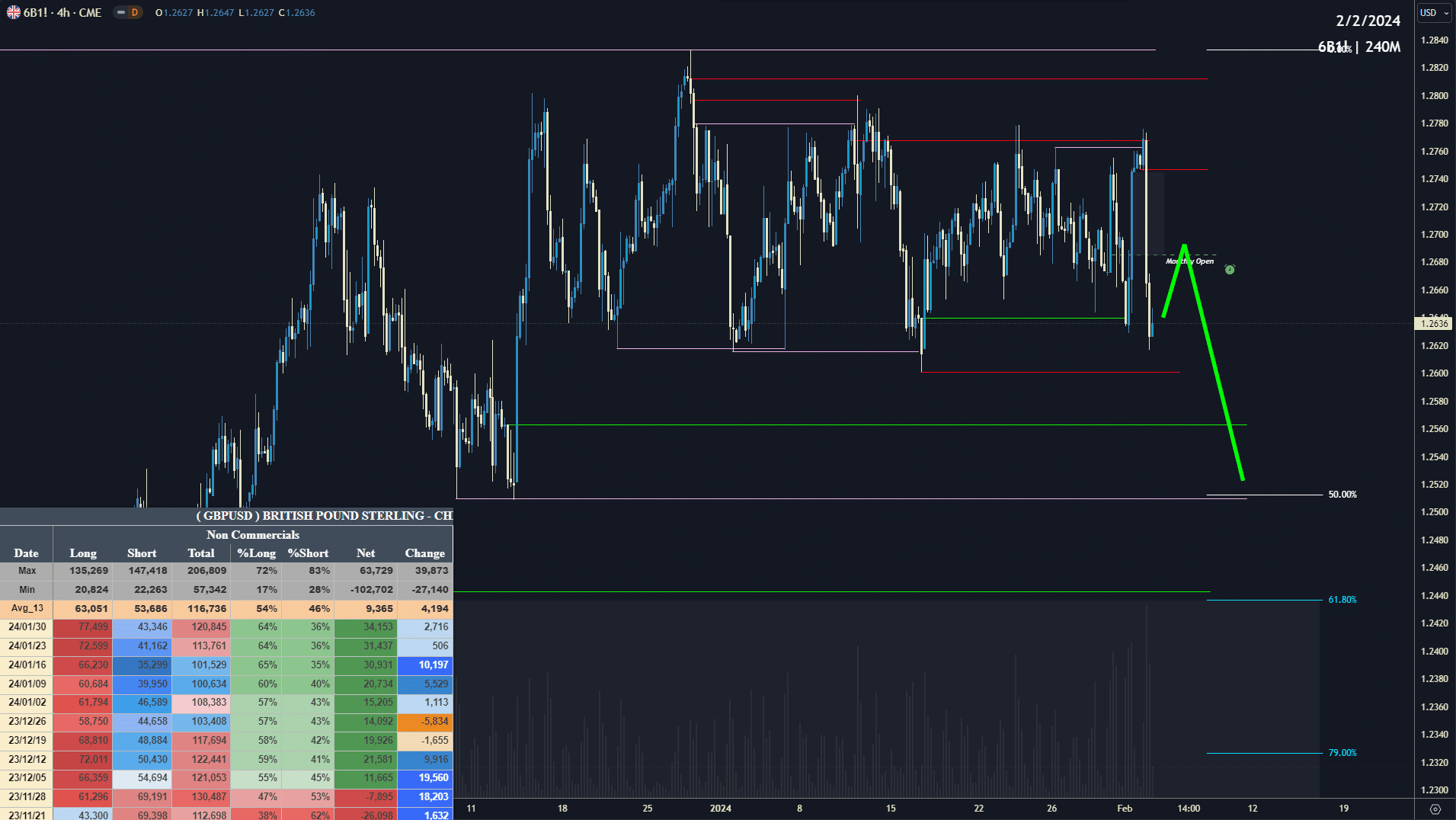

GBPUSD

The pound has been in the range for quite some time. I see a potential drop lower and monthly open and BPR would be nice levels to enter. If we look at the COT it’s still very bullish so I think GBP will not have just a pretty straight down move as other pairs and it still could be spike up and down moves but in overall tone down.

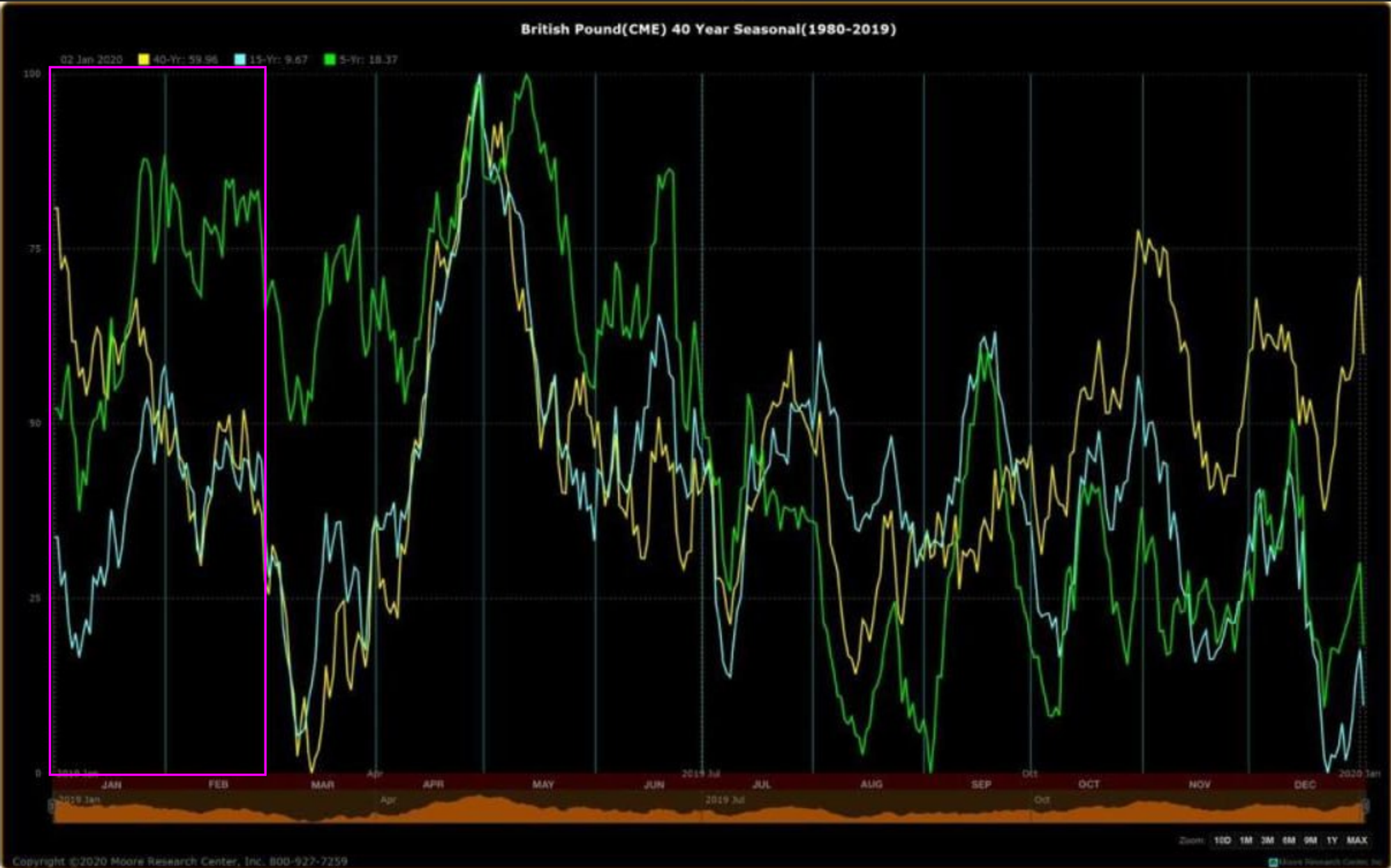

GBP Seasonal Tendencies

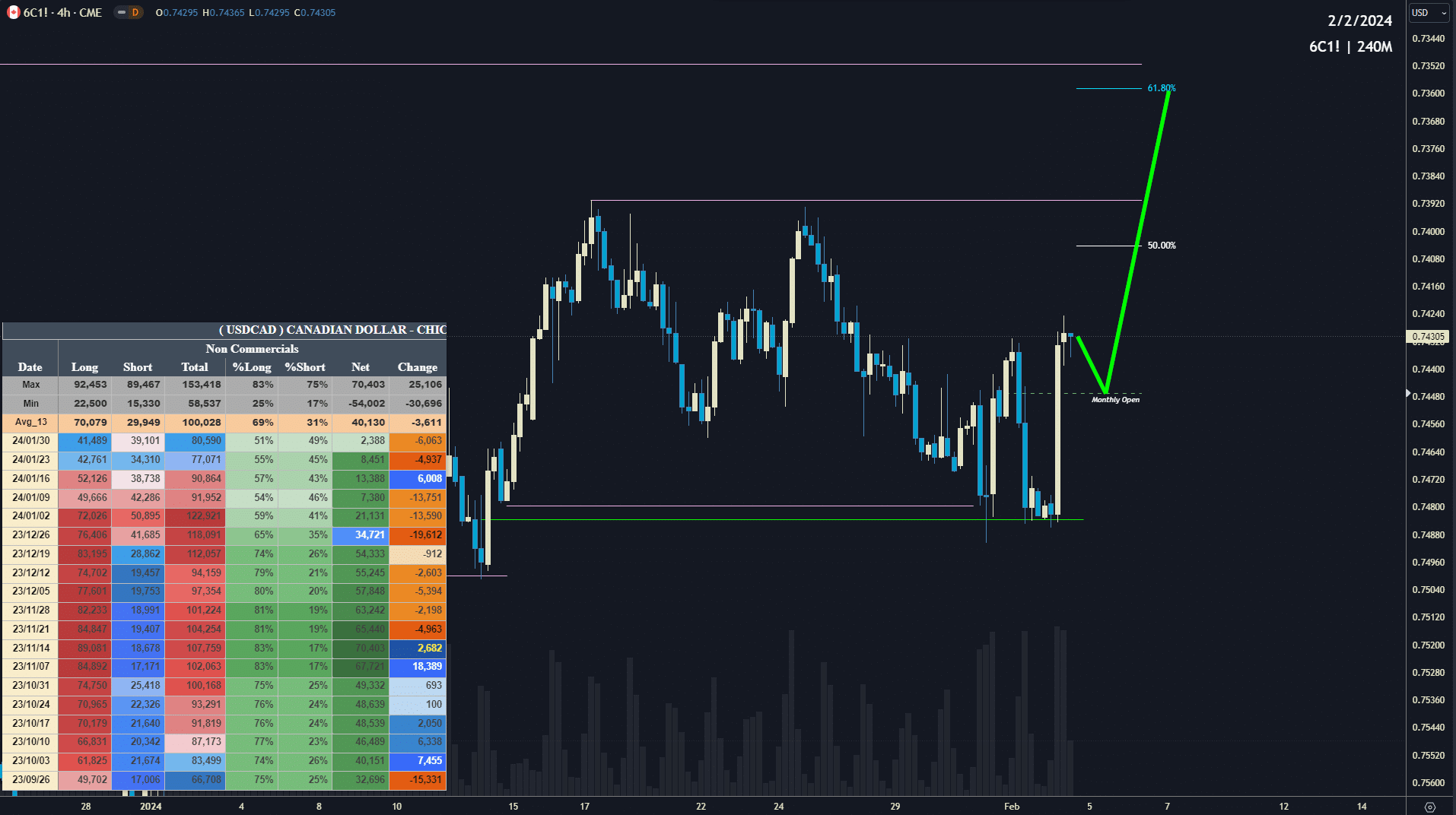

USDCAD

USDCAD price topped in November when it created a yearly high right into the rejection block. Since then we can see the price moving down. In my opinion, this week still can be bullish as the price still hasn’t reached 61.8 Fib yet.

Would be interested in longs from Monthly open.

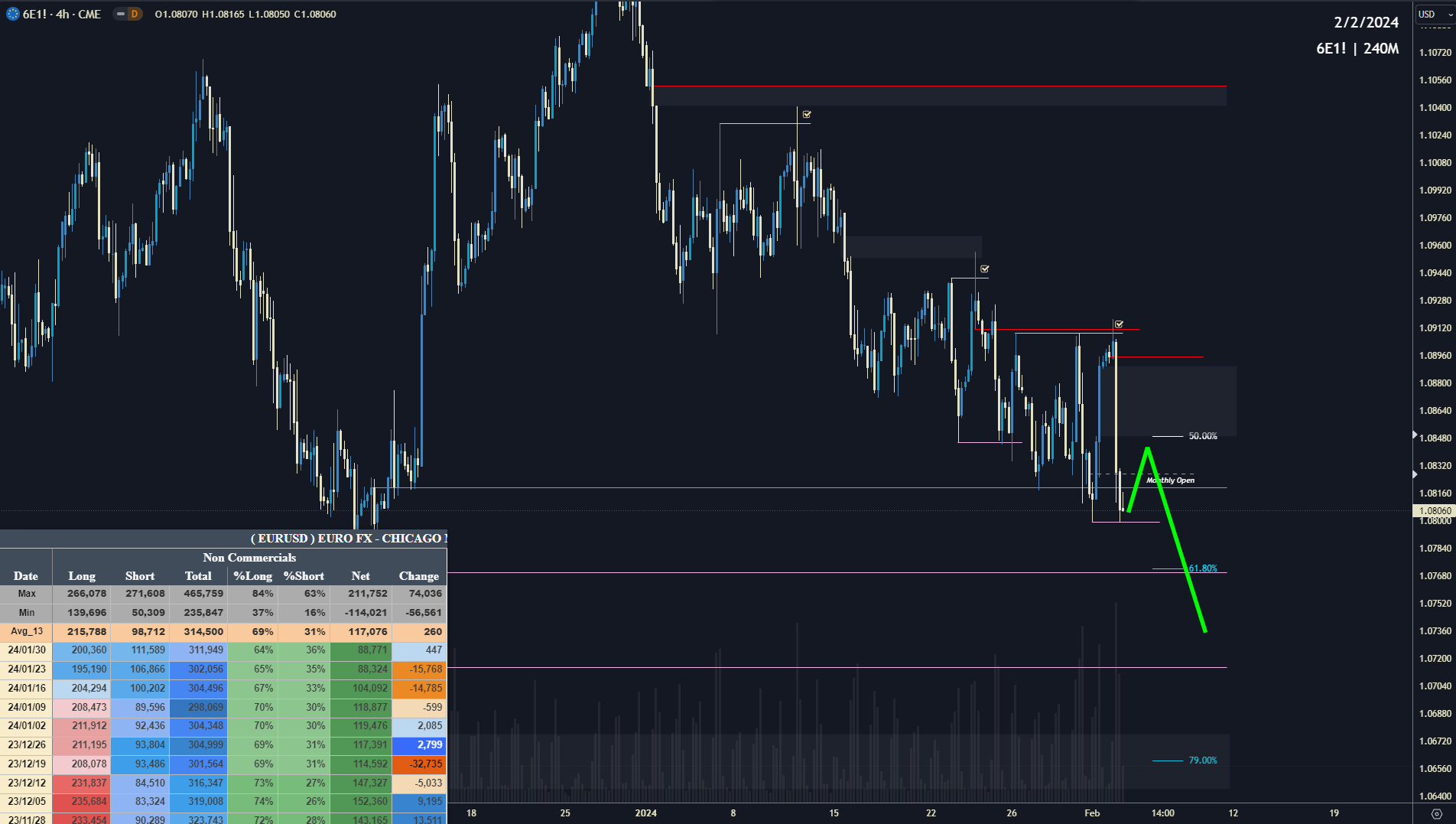

CAD Seasonal Tendencies

The Canadian Dollar has mostly been strong at end of the January / beginning of February. Which means USDCAD is down. It can be that dip before the price goes up again.