Time is more important than price

(Time of Day, Day of Week, Week of Month, Month of Year, Seasonality, News Events, 8:30 & 9:30 New York Open) + Price (Premium Discount Arrays) = Optimal Setups (Old High/Low Sweeps + MSS + Displacement + FVG)

Trading Time

NY AM session for indices: 8:30 – 12:00

NY PM session: 13:00 – 16:30.

No trades during NY lunch.

Forex kill zones

London – 02:00-05:00 NY time

New York – 07:00-10:00 NY time

Daily routine

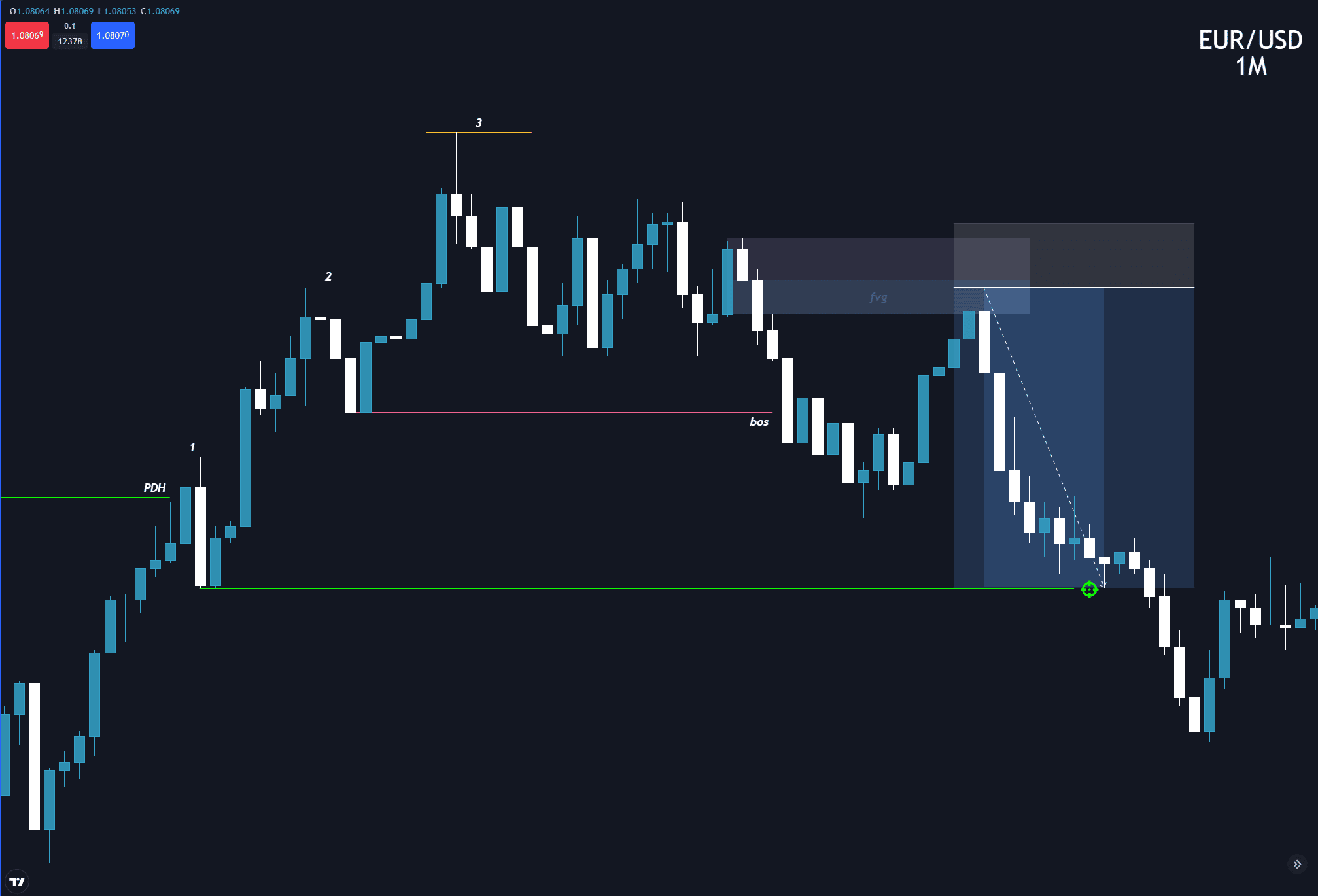

- Before the session opens, mark the HTF FVG and previous swing high and swing low for the potential price sweeps.

- Don’t open any social media, and turn off all notifications that could distract your focus

- Check the economic calendar for high-impact news – Forex Factory / MyFXbook

- Check the MT4 – 30 minutes before the London Kill zone

- Go thru your pairs and look where are PDL/PDH, and identify HTF order flow (PWL, PWH on Mondays)

- Mark out valid higher time frame Order blocks and Fair value gaps around PDL / PDH

- If the Asia session was trending. Skipp London session, the probability of reversal is low.

- Wait for the PDL / PDH manipulations (Notification will come to the MT4 Phone)

- Received notification? Look for trade as per the trading model

- If successful in the London session, you are done for the day.

- if you didn’t have setup wait for NYKZ and repeat all steps (+ mark out LOKZ H/L)

- If PA is not clear don’t force a trade, skipping a trading session without hesitation is a level of maturity

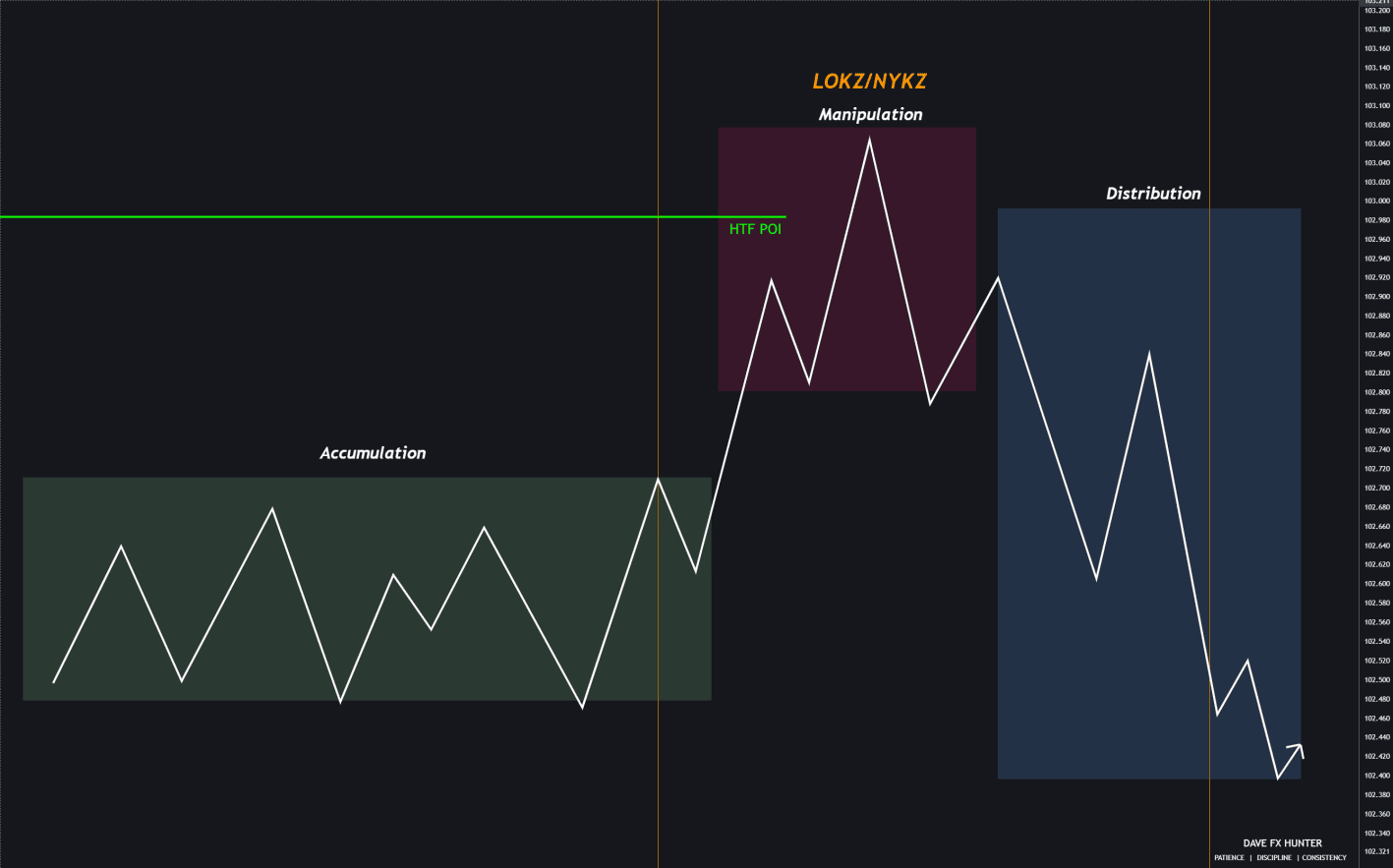

ICT Power of 3 (PO3)

Consolidation, then manipulation (the false move), and then an expansion in the opposite direction (the real move). Also known as AMD, or Accumulation, Manipulation, Distribution.

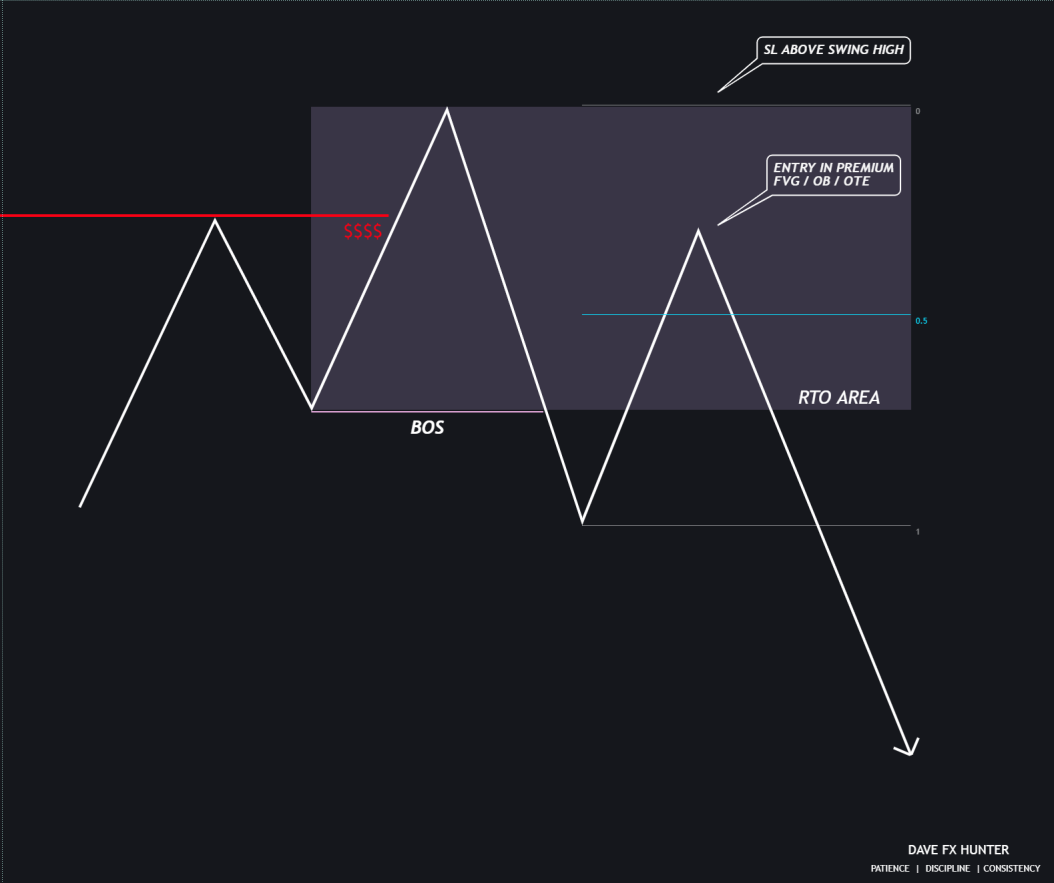

3 Drives Pattern

3 continuous higher highs or lower lows to take out liquidity and then a large reversal expansion in the opposite direction.

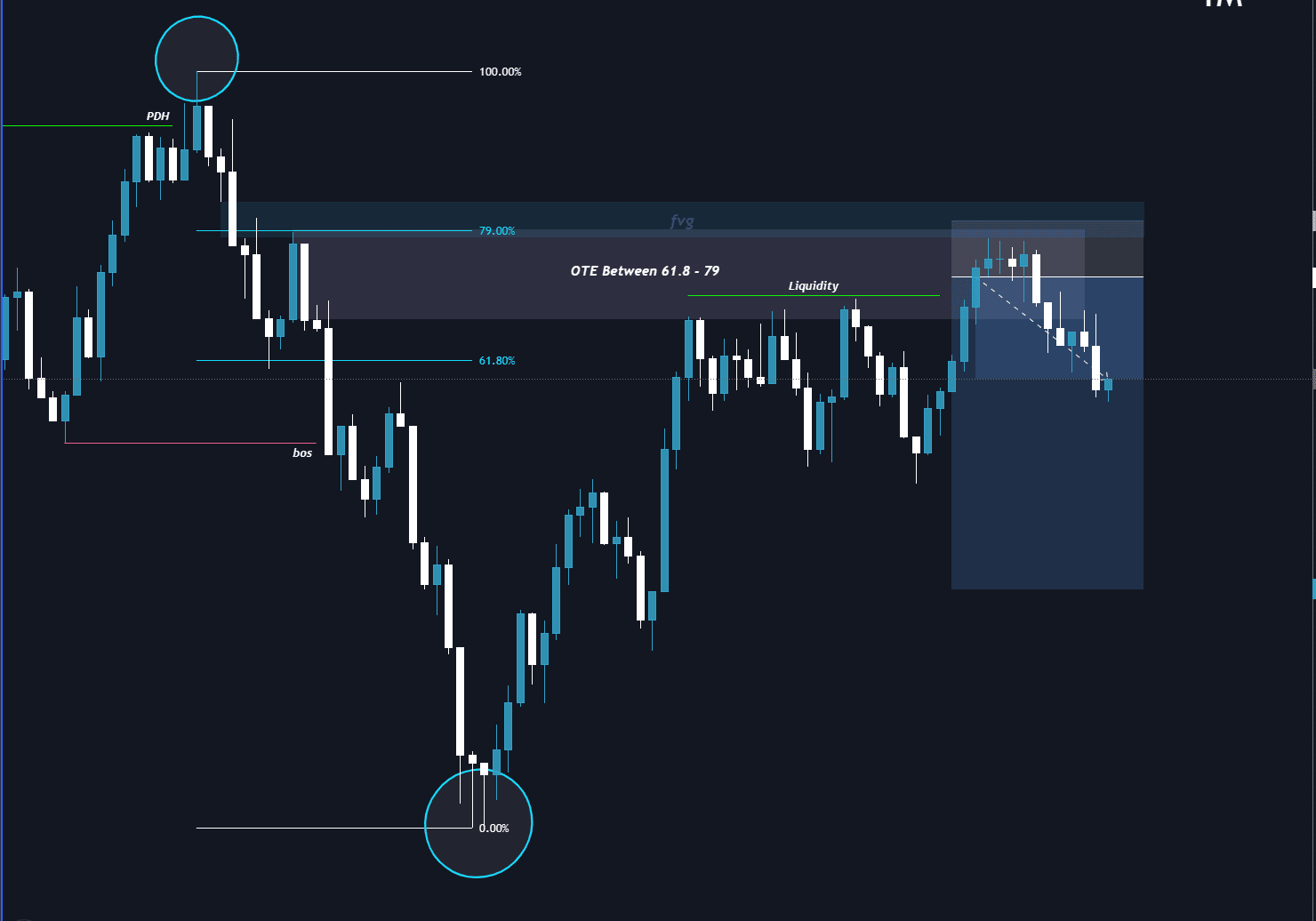

Optimal Trade Entry (OTE)

Optimal entry for a trade. Put a fib over a price swing and the OTE is between 0.62 – 0.79 fib levels (showing the Discount or Premium).

- Do not attempt to trade both sides of the market. Decide your bias and trade based on it.

- Look at the Weekly and Daily candles. Which direction are they most likely to expand in? This is how you decide your daily bias.

- If there are a few FVGs when trading your model use the one that gives the worst risk/reward because the price may not trade to the best FVG.

- if the FVG is big then place SL above/below the high/low of the candle the FVG is formed in.

- If the FVG is small then place SL above/below the swing high/low.

- Do not trade Wednesday – Friday during NFP weeks.

- Do not trade big event days (FOMC-related or High-Impact Speeches).

- If a trade is lost, half your risk you used on the next trade.

- If you lose again, half the risk again. Example: From 1% risk go to 0.5%, then go to 0.25%.

- If you make back half of the previous risk, you are permitted to return to your original % risk.

- When prices reach 50% of your target, raise/lower your SL by 25% of the entry price.

- When the price reaches 75% of your target, move SL to entry.

- Collapse the trade if your TP isn’t hit during the session you take the trade.

- Focus on one market only and master it.

- Liquidity sweeps are not 100% guaranteed reversal.

- On consolidation days, there usually will be a manipulation between 3-4 pm and then move toward the equilibrium of the daily range.

- Indices price action is worse in the Summer months.

- The news cannot be used as a directional tool, all we know is that volatility will be introduced into the markets. Use ForexFactory for the news.

- It’s okay to not have a bias or not know where the market is going to move. If you don’t know what is going to happen, leave the charts and come back later after some PA develops.

This is really summarized info from the whole trading mode. I highly recommend you watch all 41 videos, make your own notes, and practice on the charts. Soon you will see repeating patterns that are tradable with precision.